additional tax assessed by examination

442515 Second Adjustment Document Form 5344 or Form 5403 CCP Responsibility. Contact the taxing authority if you need additional information about a specific charge on your real estate tax bill.

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

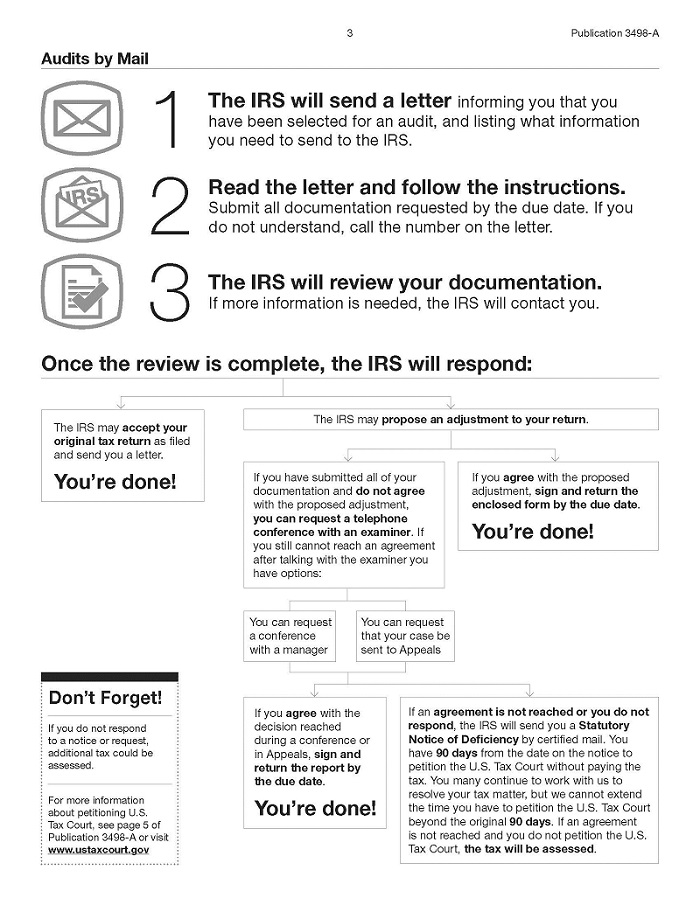

Every year the IRS selects millions of returns for examination but audits only a fraction of those selected.

. The taxpayer may also face additional interests and penalties in addition to assessed tax liability. You understated your income by more that 25 When a taxpayer under reports his or her gross income by more than 25 the three-year statute of limitations is increased to six years. NJ Rev Stat 5449-6 2021 5449-6.

If that occurs the IRS generally has 60 days from the receipt of the return to assess additional tax. Exploring Tax Audit Selection. 7-568 re additional property tax to pay current years expenses.

79 rows Individual Master File IMF Audit Reconsideration is the process the IRS uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid or a tax credit was reversed. Additional Tax or Deficiency Assessment. Special assessment taxes are only deductible when they are paid to fund maintenance or repairs Non deductible Special assessment taxes that increase the value of a property are added to a propertys cost basis.

The most aggressive tax-exempt organization enforcement initiative to date has provided lessons to the entire EO community. Additional assessment is a redetermination of liability for a tax. Upon assignment of a quiet amended return the examiner must make sure the additional tax has been assessed and if necessary make the assessment.

For example the IRS uses random sampling information comparison and computerized screening to select returns for audits. And the IRS can also file a potential tax lien or levy on the taxpayers account which can result on the IRS seizing the taxpayers assets such as a car or other property or garnishment of the taxpayers wages through their employer. 4425141 Follow-up on Form 3552.

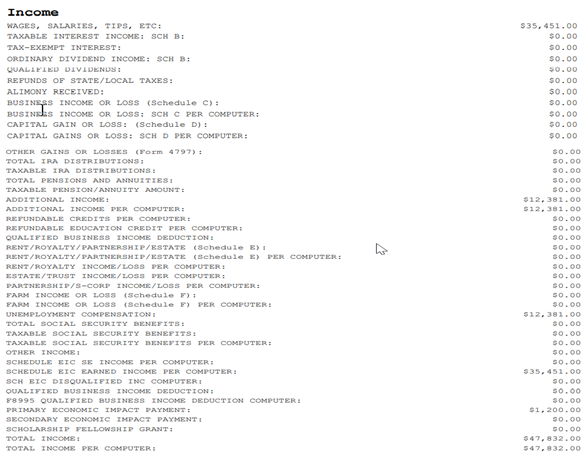

As a general rule the IRS must assess additional tax and propose penalties no later than 3 years after either a tax return is filed or the returns due date whichever is later. In 2003 the Service began a compliance project focused on. You can request Wage and Income Transcripts from IRS httpwwwirsgovIndividualsGet-Transcript and compare the numbers reported to IRS.

The following is an example of a case law which defines an additional assessment. Continue to Part 2 or to assess your answers click the Check My Answers button at the bottom of the page. Assessment of additional tax.

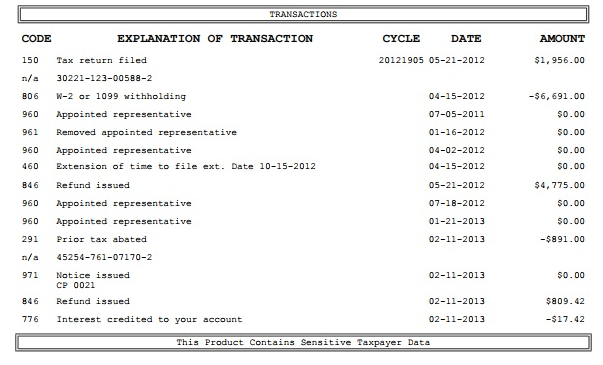

Title 54 - Taxation. Your Role as a Taxpayer. TC 300 Additional Tax or Deficiency Assessment by Examination Division or Collection Division.

It is a further assessment for a tax of the same character previously paid in part. Complete the following sentences by clicking on the correct answer. The IRS Tax-Exempt Examination Process.

1 If upon examination of any returns or from other information obtained by the department it appears that a tax or penalty has been paid less than that properly due the department shall assess against the taxpayer an additional amount found to be due and shall. There shall be a committee for the purpose of establishing a program and procedures for the training examination and certification of assessment personnel appointed by the Secretary of the Office of Policy and Management and consisting of. Agreement to Assessment and Collection of Additional Tax and Acceptance of Overassessment.

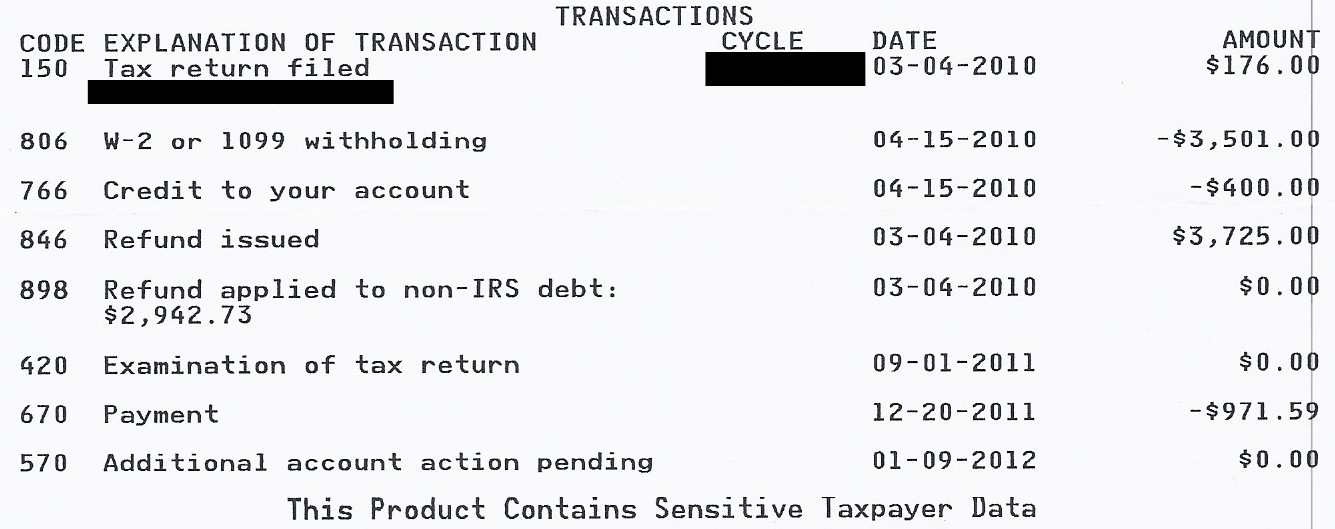

Section 5449-6 - Examination of return report. TC 420 Examination Indicator reflects that a return is under examination consideration though the return may or may not ultimately be audited. The discriminant function system is a computerized system used by the IRS.

Examination by department of returns other information Assessment of additional tax interest. TC 291 Abatement Prior Tax Assessment. The IRS characterized the 10000 fringe benefit amount as additional 2016 wages and assessed 4030 in total employment tax against the employer2500 for federal income tax 765 for the employers share of Federal Insurance Contributions Act FICA taxes and 765 for the employees share of FICA.

Once the tax is assessed in determining any additional. A special assessment tax is a surtax levied on property owners to pay for specific local infrastructure projects such as the construction or maintenance of roads or sewer lines. 575 rows Additional tax assessed by examination.

The IRS selects taxpayer returns for examination for a variety of reasons. An Examination and Audit. In determining if more than 25 has been omitted capital.

The IRS relies on a combination of random selection and specific triggers to flag tax returns that they believe. The term additional assessment means a further assessment for a tax of the same character previously. Additional Assessment Law and Legal Definition.

TC 428 Examination or Appeals Case Transfer. It may be disputed. Possibly you left income off your return that was reported to IRS.

If a taxpayer files a return before the filing date for example a Form 1040 filed on April 12th for. Is the agreement form to be used in two situations. Examination cases closed as Non-Examined with no additional tax assessed do not meet the definition and criteria of an Audit Reconsideration.

In employment tax examinations where any worker classification issue was examined and accepted and other non-IRC 7436 issues are adjusted. Examination of return report. An examination is the same thing as an audit.

442513 Follow-up on Quick Assessment Form 3210 CCP or Campus Examination Procedures. After a return or report is filed under the provisions of any State tax law the director shall cause the same to be examined and may make such. An assessment is the recording of the tax debt on the books of the IRS.

Assessment of additional tax. PROPERTY TAX ASSESSMENT See Sec. 442514 Quick Assessment Verification Form 3552 CCP or Campus Examination Procedures.

If you see TC 420 Examination of tax return on your account transcript it doesnt necessarily mean youll be audited. This article appeared in the MayJune 2010 edition of Taxation of Exempts. When the IRS selects a tax return for further study it carries out an.

The tax is charged. If youre actually being audited youll receive a. Additional tax assessed basically means that IRS did not agree with the original amount assessed and increased the tax you owe.

Immediately assess the additional tax reflected on it to insure that the Governments interests are protected.

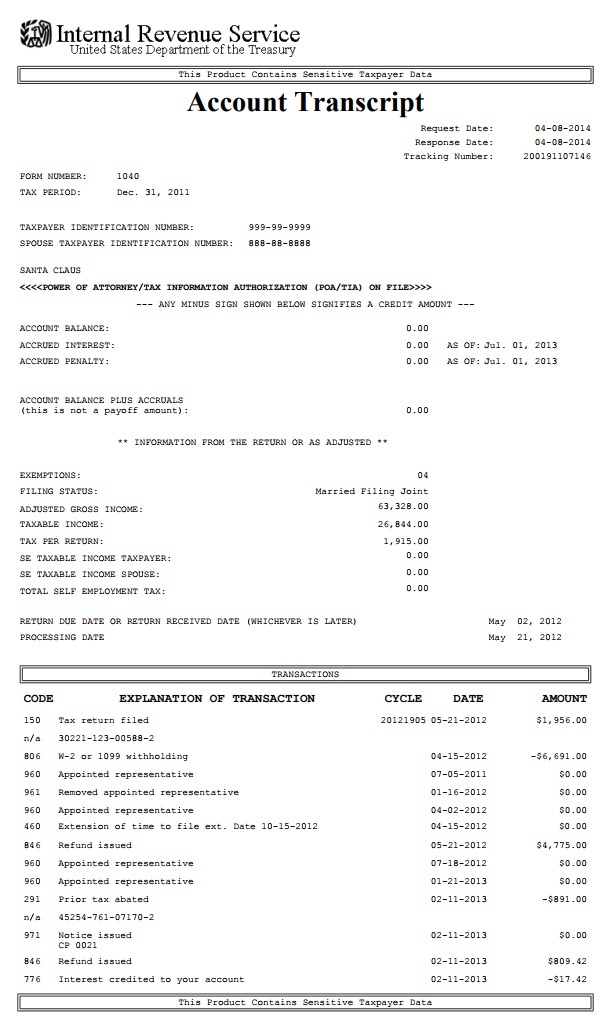

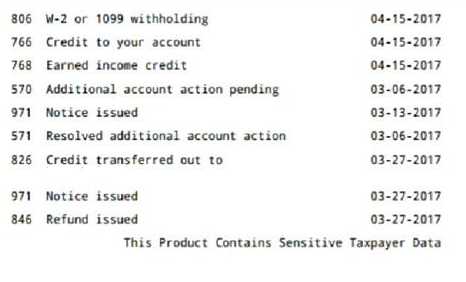

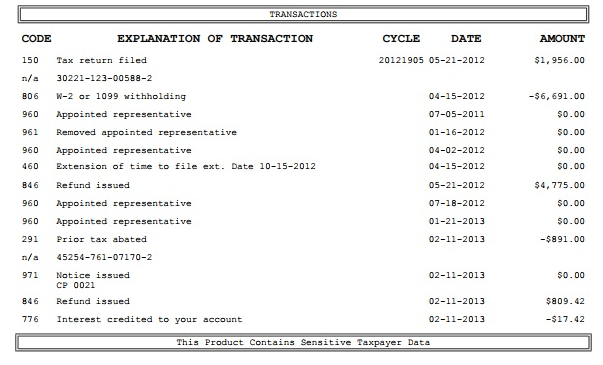

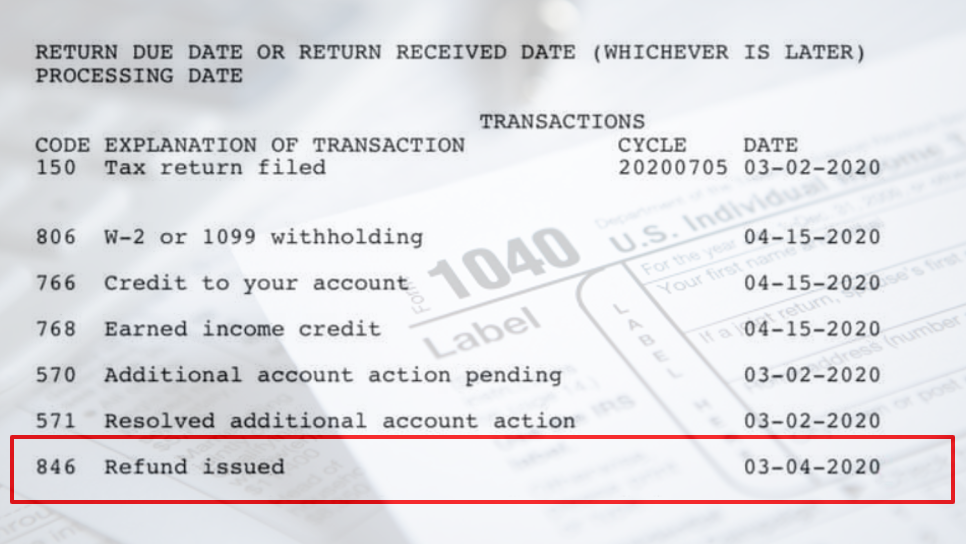

How To Read An Irs Account Transcript Where S My Refund Tax News Information

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Revision Exercise With Key Notes O Level Poa Assessment Book Tuition O Levels Syllabus

Audits By Mail Taxpayer Advocate Service

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

The Official Guide For Gmat Quantitative Review 2017 With Online Questions Gmat Gmat Exam Writing Assessment

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

![]()

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Accounting Outsourcing Services Provided Nexrise Outsourcing Accounting Accounting Services

How To Read An Irs Account Transcript Where S My Refund Tax News Information

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Meaning Of Irs Tax Transaction Codes On Wmr Irs2go And Account Transcript For Your Tax Return And Refund Status 150 151 152 203 420 421 570 846 898 971 1121 1161 Aving To Invest